This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

Taylor Wimpey Page 7

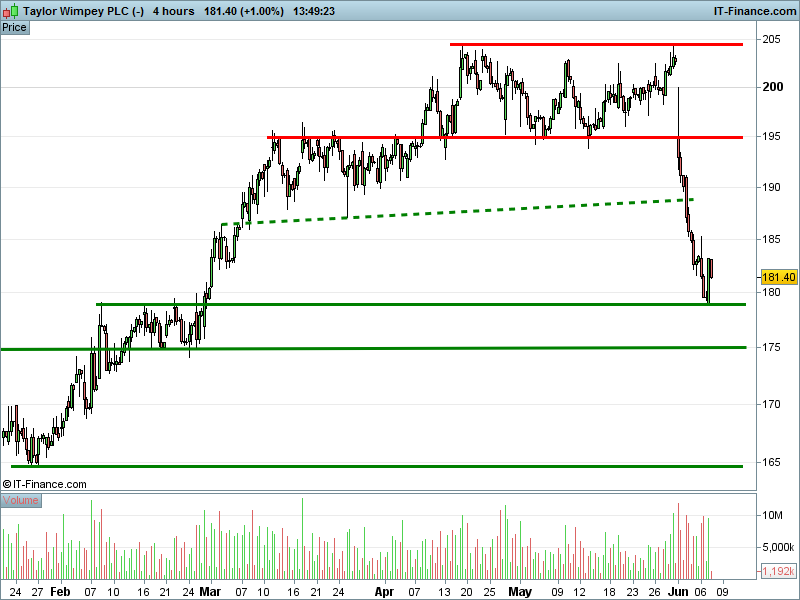

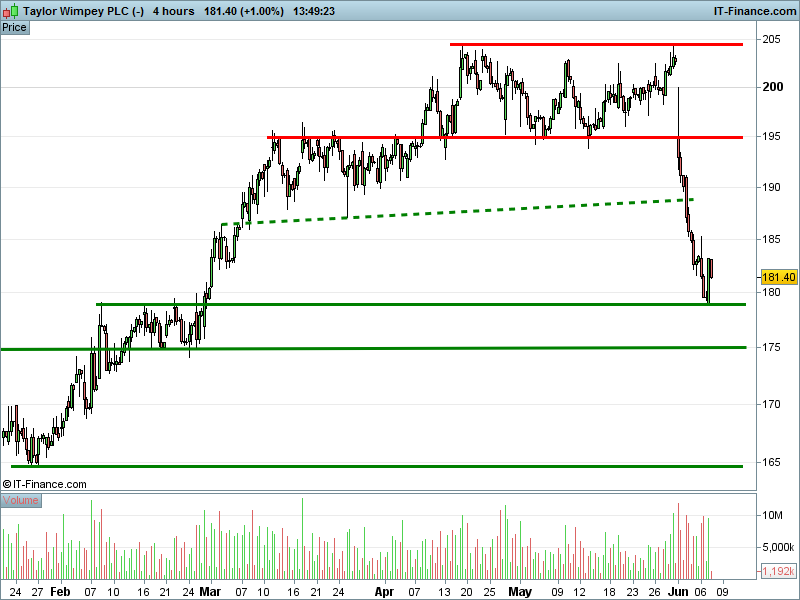

Taylor Wimpey (TW.)

UK Housebuilders were one of the hardest hit sectors after last year’s Brexit vote, however the subsequent recovery by the country’s largest names has been astounding. Having fallen 28% on the day after the referendum, Taylor Wimpey has risen to trade above their pre-Brexit levels and within touching distance of 2016 highs. Although the shares haven fallen sharply after an exentuated post-dividend sell-off, will the promise of shares trading at their lowest level since February see bargain hunters lift it back up again?

Will shares rally to fresh 2017 highs of 205p (+13%) or pull back towards 2017 lows of 165p (-9.1%)?

- Shares have found support at 180p having fallen from 2017 highs. Will the bounce continue?

- Three quarters of brokers are expecting the price to rise, with consensus target 10% above current level

- Stochastics remain oversold while Relative Strength Index (RSI) has recovered from same level

- Directional Indicators negative but converging bullishly

Broker Consensus: 47% Buy, 47% Hold, 6% Sell

Bullish: Jeffries, Buy, Target 237p, +30% (23 May)

Average Target: 200p, +10% (8 Jun)

Bearish: Cenkos Securities, Hold, Target 158p, -13% (3 May)

Pricing and consensus data sourced from Bloomberg on 8 June. Please contact us for a full, up to date rundown.

« Back to Category

This research is produced by Accendo Markets Limited.

Research produced and disseminated by Accendo Markets is classified as non-independent research,

and is therefore a marketing communication. This investment research has not been prepared in accordance

with legal requirements designed to promote its independence and it is not subject to the prohibition on

dealing ahead of the dissemination of investment research. This research does not constitute a personal

recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published,

and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up,

and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of Research