Miners at record lows

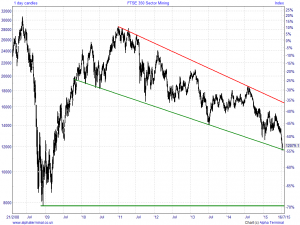

UK Index mining stocks have fallen from grace of late with share prices posting losses over the past 5 years of up to 85% (in the case of Lonmin (LMI)) in the midst of dire conditions in the raw materials sphere.

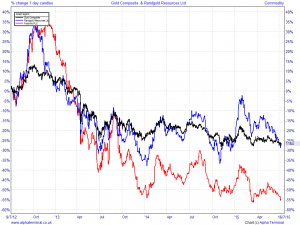

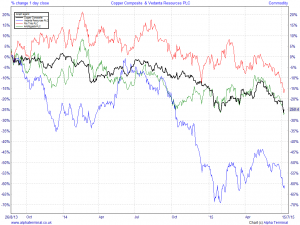

We’re wondering just how much further these stocks can fall before finding support. The situation in China is making for volatile (aka opportune) times in the commodity markets and with an end in sight to the Greek debt saga, but could and impending return to certainty be set to reinvigorate the sector? However things pan out, we thought it best to have a look at the UK Index miners to see if real opportunities are likely to present themselves imminently.

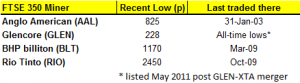

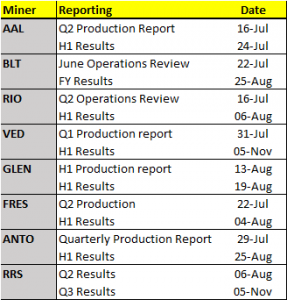

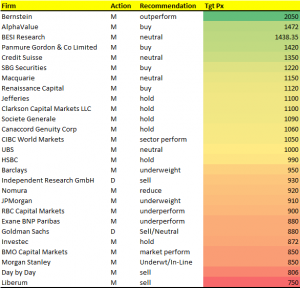

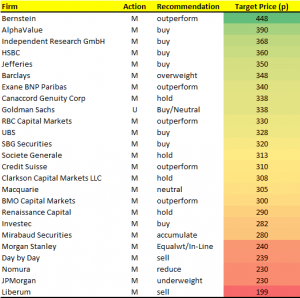

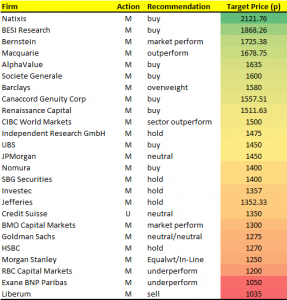

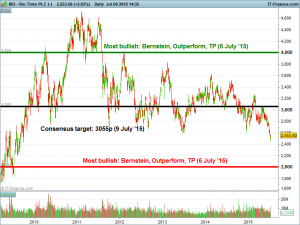

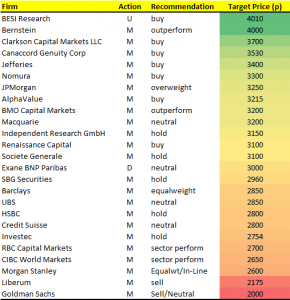

In this exclusive report we’ll concentrate on the big names in the UK 100 - Anglo American (AAL), BHP Billiton (BLT), Glencore (GLEN) and Rio Tinto (RIO), looking at the key macro drivers for the sector as well as some technical levels and broker recommendations for each stock.

Levels not seen since…

Some of the UK 100 miners are now trading at levels not seen for many years. Since UK 100 made all-time highs in May 2015, Chinese market volatility and general global uncertainty have pressured already strained commodity prices.