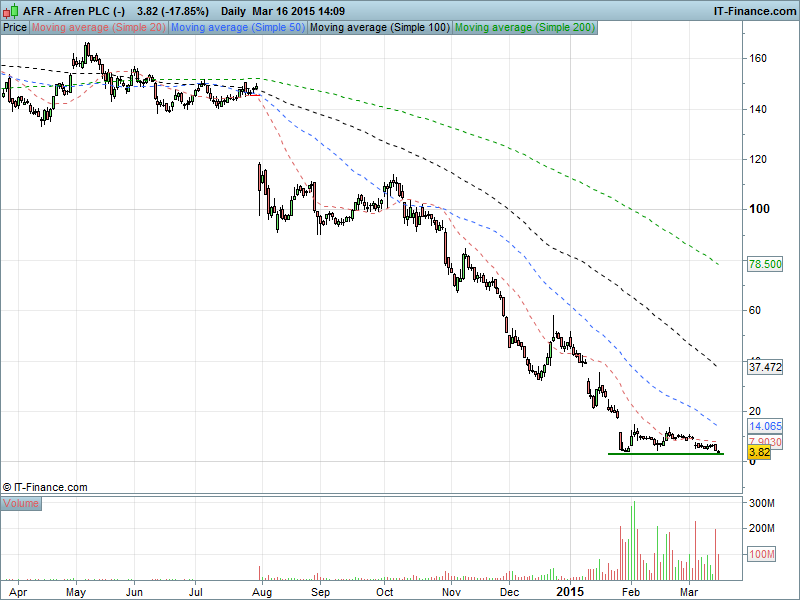

It's likely you’re all au fait with the UK 100 , but something like UK Index Small Cap or AIM may not be as familiar. And if you’d heard of the indices, what do you know about their constituents? The likelihood is that it's not a lot - small cap shares or ‘alternative investments’ as they’re also known don’t benefit from the attention their blue chip counterparts garner from thousands of analysts worldwide. This means they are largely under the radar of the institutions which is good for you, the trader, since you have the opportunity to get in there before the big hitters snap up swathes of shares and effect large price movements.Small cap stocks are popular with the investor seeking high growth potential over the longer term - a company with a (small) market cap of $500m has more potential to double in size than one with a market cap of several billions. Indeed, UK 100 heavyweights Barratt Developments (BDEV), St James’s Place (STJ) and ARM Holdings (ARM) were once small companies that have doubled in size (possibly more than once) over their lifetimes. How would it feel to have gotten into those stocks early?!Hindsight is a wonderful thing, of course, and that is why in this exclusive report we want to equip you with foresight by taking a look at several small cap stocks that are extremely popular right now for their potential to register huge share price moves of 5% or more in a single trading day, and even double (or halve) in size over the long term.Whether you are a short term trader looking to profit from high intraday volatility or a long term investor seeking the next market leading tech stock or challenger bank, the small cap indices are where you need to trade.See below for our small cap stocks to watch in Q2 2015.