Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

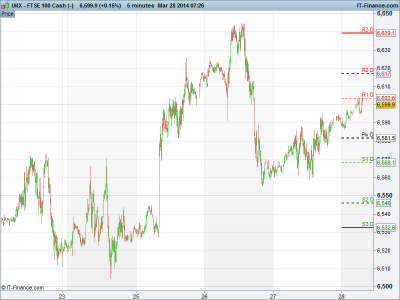

The UK 100 is set to open up 20pts at 6606pts after closing in the red by 17pts yesterday. A key driver for the modest decline is the ongoing Russia/Ukraine situation as the US House of Representatives prepares to confirm further sanctions against Russia and provide aid to Ukraine today.

US Markets closed slightly softer with indices registering losses between 0.19% and 0.5%. Investors lacking the confidence to commit amid geopolitical tensions and banks failing stress tests nearly six years after the financial crash.

Asia trading provided a reason to be cheerful, the MSCI Asia Pacific Index heading for its biggest weekly gain in almost a year. The Hang Seng the standout performer notching 244pts as traders attempt to get in to deflated stocks ahead of anticipated Chinese stimulus measures.

Royal Bank of Scotland (RBS.L) fell 1.4% and HSBC (HSBA.L) by 0.5% as their US units failed Federal Reserve stress tests. The selling extended to Barclays (BARC.L) down 1% but stopped short of Lloyds Banking Group (LLOY.L) up 0.25%, the company’s interests focussed this side of the pond.

Elsewhere Tullow Oil (TLW.L) fell 2.3% on a disappointing oil well update in Kenya. SSE (SSE.L) fell 2% after Ofgem, Britain’s energy regulator, asked the Competition and Markets Authority to investigate the retail market amid speculation of price fixing. Randgold Resources (RRS.L) and Fresnillo (FRES.L) share prices eroded 2.7% and 4% respectively as precious metal prices softened. Gold fell to a six-week low of around $1290.

The heaviest decline came from engineering service firm Babcock International (BAB.L), shares fell 6.7% after the company announced a £1.1bn rights issue to fund the acquisition of helicopter outfit Avincis which comes with £705m of debt.

In focus today: UK GDP at 9:30, EU Economic sentiment indicator at 10:00, US Personal spending, CPI, Personal income at 12:30, DE CPI at 13:00, Reuters/Michigan Consumer Sentiment at 14:55, FED’s George to speak at 16:45.

Commodities: Copper rose as much as 0.7% to $6,604.50 tn, and is set for its second weekly gain on concern supplies from global mines will trail forecasts amid speculation demand may increase in China. Gold rose as much at 0.30% to $1,294.48 oz trimming its losses for the week as speculation the drop below $1,300 oz will spur demand against signs of US recovery. Silver also advanced 0.40% to $19.7831 oz, Platinum also gained 0.40% to $1,404.50 oz and Palladium climbed 0.60% to $763.50 oz. WTI crude rose 36cents to $101.64 a barrel, while Brent crude rose 7cents to $107.90 a barrel amid shrinking stockpiles at the U.S. oil storage hub in Cushing, Oklahoma, and concern the crisis in Ukraine threatens Russian supplies.

FX: Sterling rose 0.20% to $1.6609 against the dollar and 0.50% to 82.70p per Euro and is set for is fourth day of gains as retail sales rose more than expected. Sterling has risen 10% in the past year, the best performer of 10 developed-nation currencies tracked by Bloomberg.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- UK GFK Consumer Confidence BETTER

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Qinetiq on course to meet targets for financial year

- Capital and Counties and TfL enter joint venture to develop London’s Earls Court

- Diageo announces changes to executive committee

- ITE Group sees 2 mln stg profit hit from Ukraine situation

- Aviva sells River Road to Affiliated Managers