Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

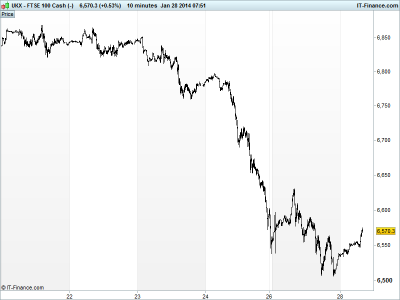

UK 100 called to open +15pts at 6575, a welcome bit of green, and after twice venturing as low as 6504 overnight as uncertainty remained within global markets after mixed US data, although US markets did improve into the close (even testing positive) and Asia-Pacific is showing signs of resilience after several days of turmoil.

Asian stocks still slightly bloodied amid concerns over the impact of continued tapering ahead of the Fed’s latest update tomorrow and slowing China Industrial Profits adding to the recent uncertainty surrounding the geography. Nonetheless, news that ICBC clients may recoup funds from a failed trust and the PBOC injecting more funds into the money markets have appeased.

However, sentiment in Asia still held back by tech giant Apple reporting a disappointing set of Q1 results, not financially, rather with sales of 51m iPhones missing consensus 55m, and implied lower guidance for Q2 following Samsung’s warning of weak earnings last week and LG’s miss yesterday. Apple shares -8% after hours.

Australia’s ASX is the underperformer as it returns following a public holiday, after the AUD bounced back versus USD following improved business surveys and China Profits stoked the fires of worry denting miners. Emerging markets growth and stability jitters still bubbling, but less so.

Japan’s Nikkei managed a near breakeven finish helped by improved Japanese Small Business Confidence and Corporate Service Prices suggested improving inflation. India also surprised markets by increasing its benchmark interest rate. Note Moody’s cutting Sony to junk.

In Europe, Bundesbank head and ECB member Weidmann assured no inflation/deflation risks while Dijsselbloem, head of the Eurogroup of Finance Ministers warned that Greek aid will be halted until the Troika report concludes positively. Italy’s Letta and Spain’s Rajoy upbeat on prospects while ECB’s Noyer reiterated accommodative policy for a ‘long time’

In focus today we have UK Q4 GDP seen a touch slower sequentially but accelerating on an annual basis. Growth in the UK Index of Services (80% of GDP) seen improving in November.

In afternoon, we have Q4 results from Dupont and Ford, while US Durable Goods Orders (notoriously volatile) are seen slowing in December as US House Prices held up well in November. US Consumer Confidence and Richmond Fed Manufacturing seen unchanged. After the US close, results from AT&T and Yahoo!

UK 100 found support at 6504 a level we had pointed to as long-term rising support from the crisis lows of March 2009. This could bode well after the 5.2% sell-off since last week. Also this morning after futures moved back above 6565 that the index may be in the middle of a double-bottom pattern with upside potential to 6630 highs of yesterday.

Gold back from its high of $1280 yesterday as the equity sell-off slows and safehaven-seeking eases.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- AU Business Confidence Improved

- CN Industrial Profits Slowed

- JP Small business Confidence Improved

- IN RBI Interest Rate decision Surprise increase

- DE Import Price Inflation Worse

- DE Siemens Q4 Results Better

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Rio Tinto in talks to sell Quebec aluminum plant

- Greencore sales up 7.2 pct, sees improving UK economy

- F&C grows 2013 net inflows to 1.3 billion stg

- Crest Nicholson FY profits rise 40 pct, forward sales up 51 pct

- British Land occupancy up to 97 percent

- British Land lets Leadenhall space to serviced office provider Servcop

- Afren sees double-digit production growth over next five years

- Gem Diamonds’ Q4 Letseng mine output rises 7 pct from Q3

- Aquarius Platinum says concerned about regulatory uncertainty in Zimbabwe

- UK’s Carpetright warns on profit again

- Fresnillo hits silver production target as explosives ban continues