Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

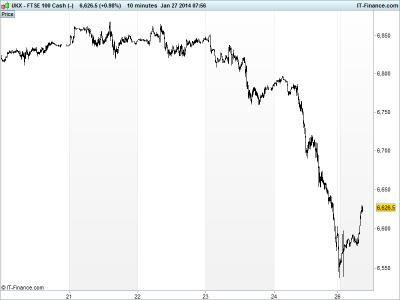

UK 100 called to open -30pts at 6625, having taken another leg down following Friday’s European close as US bourses closed -2% on persistent emerging market jitters (China/global recovery, FX devaluation, tapering, political unrest). We are, however, off our worst levels in spite of Asian bourses having a bad start to the week (biggest 3-day drop in 7 months) and the emerging market VIX hitting a 2yr high.

In Asia, Japan’s Trade Balance data was mixed but remained in deficit while BoJ minutes suggested the effects of easier policy were steadily increasing, but members did note a need to watch the effects of the April Sales tax hike and poor exports data linked to still weak global conditions and the weak JPY.

Japan’s Nikkei sits 2.5% lower hindered by the emerging market – turned global – sell-off and the JPY strengthening to a 7-week high versus the USD on safehaven seeking. Hong Kong off by 2%. Regional sentiment also likely hindered by a results-miss from LG adding to growth fears. Note Australia closed for Australia day.

Over the weekend, ECB President Draghi spoke at the World Economic Forum in Davos and noted that while there are better signs for the Eurozone (no deflation), it is slow and there are still downside risks. Also hard data is not the same as surveys. With so much focus on whether the ECB will ease policy further, he did hint at the possibility of buying ABS if “easy to understand, price, trade and rate”.

The BoE’s Governor Carney also used Davos to reiterate many of last week’s points with the unemployment threshold being downplayed within forward guidance and an update on framework soon. Overall though, rates to stay low and any increases to be very gradual.

After the ratings agency action of Friday on the UK and Germany, Moody’s updated on France, reaffirming its AA1 rating and negative outlook. The ECB’s Knot also played down the prospect of any more ECB action without an adverse shock (emerging market rout any good for you?)

In focus today we have German IFO Surveys seen improving slightly. US New Home Sales are likely to have remained weak in December hindered by seasonality and weather. The Dallas Fed is seen flat. Central Speakers are a plenty and we get results from Caterpillar and Apple.

This week we also get an update from the US Fed FOMC, the last for Bernanke before Yellen takes over, and all eyes on whether the tapering course of QE3 will be maintained at $10bn/month.

UK 100 futures fell as low as 6537 overnight before bouncing back above 6600. We note that this didn’t quite take the index as far as the 4-year rising lows at 6500, and it did test the 200-day moving average rather than bounce off it. Could we have further to fall? Note daily momentum finding support.

In FX, the USD index holding back around 80.5 after the test of 80.2. As for GBP/USD, back down at 1.65 after Carney talked down rate rise. EUR/USD doing well near to 1.37 despite FX volatility. USD/JPY down at 102.7, after bouncing at 102.

Gold benefiting from safehaven demand, testing key $1270 level of December highs.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- JP Trade Balance Mixed, still deficits

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- UK Broker ICAP to lose role in ISDAfix swaps benchmark

- Vodafone in talks to buy Spain’s cable operator ONO –Bloomberg

- AT&T says does not intend to make an offer for Vodafone

- BG Group issues “disappointing” 2014 guidance

- Albemarle & Bond says sale process terminated

- Chemring completes sale of build-to-print business to AMTEC Corporation

- Speedy Hire appoints Mark Rogerson as chief executive

- Premier Foods, Gores Group to jointly operate Hovis

- Salamander Energy sees Bualuang field production restarting in early Feb

- Aveva says continuing to perform well

- ARM says Stuart Chambers to replace John Buchanan as chairman

- McColl’s Retail to float on London Stock Exchange