Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

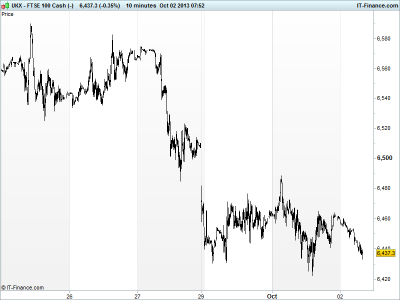

UK 100 called to open -10pts at 6440, still under pressure as we enter day 2 of the US government shutdown, with blame apportioned to Republicans who appear focused on scuppering Obamacare, whatever the cost, and some expecting a long wait and impasse re-run come the deadline for the even more dangerous debt ceiling.

Negative opening calls in Europe despite a positive close for Wall Street as markets shrugged off the budget impasse and hoped for quick resolution, and despite Treasury secretary Lew saying he’s using tools to preserve borrowing authority but coffers will run dry on 17 Oct.

In Asia, equities mostly higher as US budget situation seen short-lived, except for Japan’s exporters suffering from the stronger JPY – a product of safehaven seeking while USD is shunned – and lack of details on Abe’s stimulus package (no cut in corporation tax to balance rise in sales tax).

Data overnight included an increase in the Japanese monetary base, thanks to the mega monetary stimulus programme. In Australia, the trade balance missed expectations although it did improve when we factor in a downwardly revised prior month and Building Approvals deteriorated, slowing up markedly in August.

Asia in the blue despite, the Asian development bank taking the red pen to its China growth forecasts while the Chinese President said determined to stabilise growth (obviously still worried).

In the UK, note press coverage of many UK banks unsure about government’s help-to-buy scheme. Worried about low deposits and high LTVs and bad debts. Sign of a bubble or contra-indicator? Also talk of tougher annual BOE stress tests for banks. Retailers Tesco and Sainsbury post results out this morning. How are things in the work of groceries?

In focus today, we have UK PMI construction seen edging ever higher towards the 60 level (we’ve not seen a 60 reading for a PMI for a while). The ECB is seen leaving rates unchanged, even if benign inflation in the region makes the case for a cut. The press conference will be the highlight, given recent noise about another LTRO.

In the afternoon, with the US government closed for business, all eyes on industry data in the absence of official readings. With no NFP likely on Friday, the warm-up act ADP will be the essential update for Fed watchers, with a slight increase in jobs creation expected.

With politics so dominant at present note we have the confidence vote for the Italian PM and his governing coalition, will Berlusconi’s men stick with the PM? PM Letta speaks in the afternoon, with UK counterpart Cameron doing the same late morning.

In the evening, it’ll be interesting to see what Fed Chairman Bernanke has to say about the shutdown, given that it was one of the non-data reasons for holding back on tapering in September.

UK 100 under pressure near early September lows. Futures in declines since midnight having found resistance at the 6460 level of yesterday’s market close. Support 6420. US stalemate and Italian developments likely to dominate, although Super Mario Draghi (ECB) may provide soothing backstop words.

In FX, USD recovered to 80.35 overnight, but since weakened. Falling highs since 29 Sept keeping a cap. Steep rising lows broken at 80.3 could see further weakness, especially while Budget impasse and countdown to the debt ceiling persists.

GBP/USD back from 1.625 highs as USD strengthens to trade below 1.62. Major multi-year trendlines proved too much. EUR/USD also back off 1.359 highs to trade 1.352. ECB communication and Italian confidence vote the likely movers today. Gold below $1300 after break below $1325 and massive sell-off in spite of US impasse (maybe the yellow metal didn’t get the memo?).

US Light Crude oil settled around $101.5 and Brent the one showing more of a struggle and volatility, at $107.5. Both down near recent lows.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- AU Trade Balance Miss, improved

- AU Building Approvals Miss, Deteriorated

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Electrocomponents says first-half underlying sales grew 1 percent

- Dunelm first-quarter sales grow 1.7 pct

- Sainsbury outshines Tesco with second quarter sales rise

- Domino’s Pizza third-quarter UK sales rise 4 pct, Germany plans on track

- Hochschild Mining to grow stakes in Peru projects

- Hochschild Mining to raise up to $96mln for acquisition

- Taylor Wimpey completes the merger of legacy pension schemes

- Tesco posts flat quarterly sales in UK

- BG Group completes Pweza gas field appraisal