Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

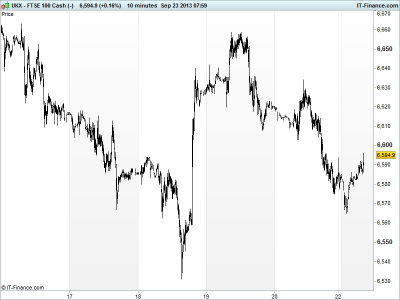

UK 100 called to open -10pts this morning at 6,590, back below that 6,600 which was broken above after last-weeks Fed taper no-show. Has the euphoria of extended easy money already evaporated?

The negative close in the US on Friday would suggest so, with blame attributable to the Fed’s Bullard suggesting an October taper. Are we going to get this every month until Dec/Jan? Speculation of WSJ Hilsenrath article suggesting no taper until 2014 was actually a video saying Fed needs more jobs data and budget resolution first.

Nonetheless, futures off their worst levels thanks to much better than expected China HSBC PMI Manufacturing which got bounced nicely off the 50 breakeven level suggesting a rebound. Talk of Citigroup suffering drop in trading revenues due to summer slowdown. Same for peers? Q3 back sector results to be disappointment?

German Chancellor Merkel’s party did well in the general election. She missed an absolute majority and coalition partner failed to stay in parliament so negotiations required for new one. With the election behind us, prepare for revival of discussions on tough Eurozone issues put on hold for the summer.

It sounds like a smooth meeting between Greece and Troika yesterday. Although post German election, things could get more interesting. Asmussen already saying (on Irish TV) that Ireland should not ease up on austerity in 2014.

Japan closed for national holiday (Autumnal Equinox), Hong Kong missed morning due to storm, Australia held back by energy, mining, staples and industrials. China in the red despite better PMI. ECB says ready to inject additional liquidity if needed says Italian newspaper.

In focus today, we have PMI data from Europe’s core France and Germany which are all seen improving slightly from their growth in August, although France’s Service sector still just in contraction.

In the afternoon, we have the Chicago Fed update for August and the US Manufacturing PMI which is seen putting the Eurozone print to shame, again. ECB President speaks shortly after and then after Bullard spooked market by saying possible taper in October, his colleagues Lockhart, Dudley and Fisher are up later to potentially muddy the waters further. Hopefully more info on why no taper, but opportunity to both clarify and confuse.

UK 100 back below 6600 although off worst levels after support at 6,560 again. Will 6600 revert to resistance? Uptrend still intact.

In FX, USD index flat around 80.5 with Friday support at 80.4. No taper maintaining weakness. GBP/USD back at 1.60 after visit of 1.62, but support available at current levels. EUR/USD holding around 1.355 still.

Gold stuck in $1300-1360 range after breakdown from rising channel.

Oil back down at worst levels of month $104.5 for US Light Crude nut Brent still shows rising lows from Tuesday at $109. Middle East still a driver with Assad goading the Western group attempting to remove Syria’s chemical weapons.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- CN HSBC PMI Manufacturing Beat, improved

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Aberdeen reports 1.2 bln stg in net ouflows

- Cambria Africa says chief financial officer resigns

- A.G.Barr posts 12 pct rise in first-half profit

- Paragon Group completes 273 mln stg securitisation deal

- Green Dragon Gas says H1 production rises 59 pct

- Ophir Energy secures rig for West Africa drilling

- Park Group says progress continued into current financial year

- Phytopharm to buy diagnostics company IXICO

- Dairy Crest says to report a steady first-half performance

- Genus to buy Canada-based Genetiporc