Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

UK 100 called to open +30pts around 6580, after a positive session in Asia as Japan bounces back after yesterday’s losses, this despite mixed macro data and modest losses in the US as markets await central bank updates. After worries over a China credit crunch, a PBOC injection into the interbank market for the first time since February has eased money and sentiment pressure.

In Europe, the IMF approved Greece’s next bailout tranche while the BoI is looking at the books of Italian banks which could force asset sales or other capital raising efforts, while investment banking giant Barclays has just announced a bigger than expected rights issue (£5.8bn) at a significant 40% discount (185p vs. 309p close yesterday) amongst other initiatives to plug its balance sheet.

Overnight macro data showed continued improvement in Japanese Unemployment, but weakness in Industrial Production and Household Spending has weakened the JPY which has helped exporting equities. Australian Building approvals unexpectedly slumped and the RBA was very dovish pretty much prepping markets for a rate cut next week, sending the AUD/USD sub-91. In Europe, German GFK Consumer Confidence improved.

The big results of the morning are Barclays‘ capital raising to meet new capital adequacy rules and its H1 pre-tax profits falling 17% to £3.6bn, missing estimates, on new provisions for mis-selling and restructuring on tougher regulations. BP production in Q2 looks to have beaten expectations, but lower prices and a higher tax rate have bitten into profits. ITV beat expectations as did GKN, while Next has upped FY guidance and Vodafone launched an official offer for Kabel Deutschland.

In European results, UBS posted a 32% jump in Q2 net profit thanks to its investment banking division along with plans to buy back the fund set up by the SNB in 2008 to help it shed toxic assets. German peer Deutsche Bank (also raised capital recently) missed on litigation charges and higher charges for bad loans. Sentiment in the sector likely to be mixed at best today. Watch UK majors RBS & LLOY.

In focus today will be European Confidence data all of which are seen improving slightly, while US Housing Prices are seen showing slower growth in May, along with a small pullback in US Consumer Confidence. In Europe, Spain and Portugal update on growth and production with both expected to show things as less bad rather than better.

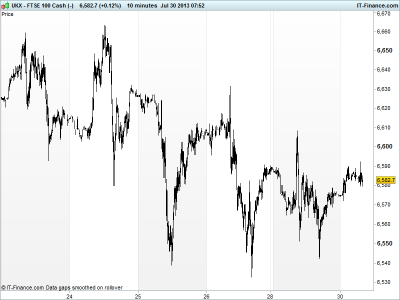

The UK 100 traded sideways since tracking down from July 6660 highs. While momentum fallen, support still valid around 6540. New consolidation range, or another pause before another leg down. Falling highs from 24-Jul still valid putting resistance at 6590, below the 6000 level we toyed with yesterday. Some good results to support index today, but also some disappointments.

In FX, GBP/USD testing trendline of rising support from 9 Jul at 1.535. Markets expecting Bernanke to announce some greenback-strengthening policy hints (tapering?). EUR/USD back from its 1.33 highs to test 1.32. Uptrend from mid-July intact. Speculation on central banks’ policy action likely to keep things interesting.

In Commodities, Gold still in its steep rising channel $1310-1350. Watch for weaker USD helping the yellow metal, but note lack of fundamental drivers (no inflation, lack of safehaven demand etc).

In Oil, prices remain weak ahead of supply figures as well as economic data which may put economic growth and energy demand prospects in focus. Crude Oil knocking around its recent $104 lows with potential resistance around $105.5. With Brent, it’s now trading just above the mid-point of its recent $106.6-107.8 range.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Japan Household Spending Worse

- Japan Jobless Better

- Japan Industrial Production Worse

- Aussie Building Approvals Worse

- Japan Vehicle Production Deteriorated

- Japan Small Business Confidence Deteriorated

- Germany GFK Consumer Confidence Better

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Tullett Prebon says H1 revenues 439.8 mln stg

- Informa first-half adjusted pretax profit rises 5.6 pct

- Jardine Lloyd Thompson’s first-half profit up at 93.1 mln stg

- Drax Group posts profit in line with expectations

- Petra Diamonds revenue up 27 pct in year ended June 30

- UK regulator says Barclays has credible capital plan

- GKN profit up 5 pct on aerospace growth

- Domino’s Pizza H1 profit dips, pushes back German expansion

- Barclays adjusted H1 pretax profit down 17 percent

- Barclays plans 5.8 bln stg rights issue to lift capital

- H.R. Owen confirms rejection of Berjaya offer

- Health authority recommends BTG liver cancer therapy

- Santander’s first-half net profit rises 29 percent

- Weir profit down on falling orders for mining equipment

- Direct Energy to buy energy marketing business of Hess for $731 mln

- BP raises oil spill charge as Q2 misses forecasts

- International Personal Finance posts record H1 profit

- Next raises year profit guidance

- Broadcaster ITV sees summer advertising boost

- Tullett Prebon reports 3 percent drop in revenues

- African Barrick eyes cuts as impairment hits H1

- Centrica buys U.S. gas supplier for $731 mln