Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

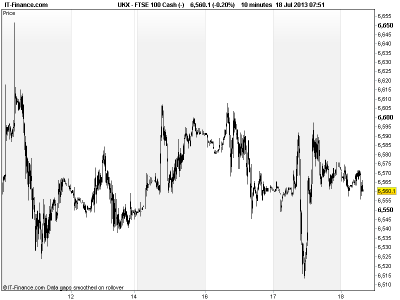

UK 100 called to open -10pts at 6560 after another mixed overnight session in Asian equities with Japan the outperformer and Hong Kong/China lagging despite a testimony from Fed Chairman Bernanke yesterday that emphasised continued stimulus for US economy which still needs help, but potential for tapering this year IF data (unemployment, inflation, economy) keep improving.

BUT no pre-set course, QE3 could stay as is, taper or even increase. Targets are not triggers rather thresholds for consideration. Many variables. Staying flexibility manage expectations and avoid markets going wild and inflating asset bubbles. Even after employment improves could carry on in inflation too low. Rates to stay very low for foreseeable future. US Beige book unchanged in its assessment of US economy (modest to moderate expansion).

Japan benefiting from optimism in Abenomics, and USD/JPY back >100 on expectations the G20 will steer away from criticising the new PM’s strategy for growth revival and that a Sunday election will see him take control of the upper house too making 3-arrow strategy implementation even easier.

China struggling under the weight of slowdown fears with the PBOC’s head of research saying growth to be 7.0-7.5% this (another mention of 7.0% spooking markets hoping for 7.5%) and the IMF saying China can weather shocks, but warning on reforms timetable and heavy reliance on credit and slowing growth. In Australia, despite S&P reiterating AAA, sentiment suffering from comments China resources investment boom over.

In focus today we have Bernanke speaking again, with more Q&A to be analysed for clues as to the Fed’s strategy for stimulus/accommodation and eventual withdrawal. UK Retail Sales seen slower in June after May’s strong report, although market may look past this, optimistic of July benefiting from good weather.

US Jobless Claims always watched given importance for Fed strategy, with consensus looking for a drop in latest week. The Philadelphia Fed is seen dipping in July. Greece putting reform bill through parliament. Spain selling debt with costs watched given Europe’s peripheral stresses. Q2 results from Nokia, Safeway, Phillip Morris, Morgan Stanley, Verizon Communications (Vodafone JV), and after the US close we have tech guns Google and Microsoft (Note IBM beat last night, Intel and eBay missed.)

The UK 100 maintains its sideways shift (6520-6610) with no real change to Fed talk and so no real driver for a second wind after the rally of late-Jun/early July. Pause to continue or momentum flagging? Results season fast approaching (banks at end of month), which would spice things up.

In FX, GBP/USD back below 1.52 after initial jump on surprise unanimous BoE vote against more QE (move to focus guidance than stimulus) Sterling but the Dollar strengthened on reiterated chance of Q3 tapering this year. EUR/USD Still in 1.30-1.32 range. In Commodities, Gold again struggled to get above $1300. Testimony part 2 could be driver for USD and Gold today. US Light Crude Oil back above $106, with potential restoration of uptrend and support since end-June. Brent Crude doing the same back at $108.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Aussie Conf Board Leading Index Growth slowed

- Aussie NAB Business Confidence Deteriorated

- Japan N’nwide Department Store Sales Improved

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Sound Oil says Stuart Joyner joins as CFO

- Optos says CFO Louisa Burdett steps down

- London Mining raises 2013 production guidance

- RPS buys APASA for up to 5.2 mln stg

- London Capital Group says CEO Mark Salde resigns

- Nostra Terra says latest Oklahoma well beats view

- Sirius Minerals requests deferral of York project approval

- H.R. Owen. says Berjaya offer undervalues company

- CRH names Albert Manifold as CEO designate

- Fenner says looks forward to returning to growth

- LSE says enjoyed positive start to the year

- Mothercare says UK underlying sales fall 0.9 pct in Q1

- Amara Mining says Sega project on track after licence granted

- Sports Direct posts big profit rise, makes strong start in Q1

- 3i says gross debt falls below 1 bln pounds

- Anglo American copper output climbs in Q2, iron ore dips

- Petrofac increases interest in Abu Dhabi JV

- Bumi agrees stake sale in first stage of Bakrie separation plan