Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

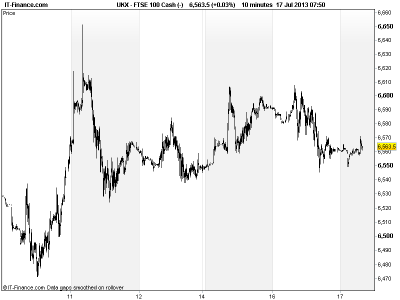

UK 100 called to open flat at 6560 with Asian equities mixed/in the red ahead of the US Fed Chairman’s testimony to Congress. Given short time since his last communication with the markets (10 Jul) it is unlikely he wavers much from what was sad last time, reiterating intentions to taper if data keep improving, but that policy to remain highly accommodative. As with last time, Q&A likely to be where any market excitement emerges (even if data improve, low inflation could keep QE3).

After Europe closed on a downer despite a lack of real data drivers, more linked to waiting for Bernanke than anything, US markets followed suit although not weak to the same extent and despite a big beat by Goldman Sachs and better US inflation and Housing data. Momentum seemed to flag after the recent rally, and possibly after the China growth slow, with central bank comments/clarification (read Fed) priced in.

In focus today – aside the afternoon’s Fed-watching – will be the UK unemployment which is seen improving with claims down another 8K but 4.5% claimant count (4.5%) and ILO unemployment rate (7.8%) unchanged.

At the same time as Bernanke’s testimony text is released and wording analysis begins (new format breaking up text and testimony, allowing markets to analyse first – may create more volatility), we have US Housing Starts and Building Permits which are seen up in June, suggesting continued consumer confidence and an improving housing market. Later Bernanke testifies to Congress with Q&A.

The BoE minutes will be of interest in explaining why the new governor introduced forward guidance in contrast to the old guard and will be looked to for new information/wording on policy going forward and expectations on interest rates and QE, and whether there has been any change in voting split.

Q2 results from more US banks, including BoNY-Mellon and Bank of America. In the evening the US with the Beige Book – the Federal Reserve’s official summary of US economic conditions – will offer more clues as to the health of the nation and could sway sentiment even after the Fed Chairman’s testimony if improving/declining markedly. After the close, the big tech guns Intel and IBM report.

The UK 100 slowed up at 6600 and traded back down to the middle of its recent 6530-6600 range, breaking the rising trendline from July 5. However, the sideways action since 10 Jul (when Bernanke last spoke) goes to reinforce our rally-pause theory with the near-10% rally being digested before another up-leg. Can Bernanke say anything new to keep things going?

In FX, GBP/USD stuck around 1.51 awaiting Bernanke’s words of wisdom/clarification/confusion. EUR/USD rallied to near recent highs 1.32 of last week. Still in 1.30-1.32 range. In Commodities, Gold sideways in-line with FX ahead of Bernanke testimony. $1300 still a hurdle. US Light Crude Oil still in uptrend, but testing trendline of rising support at 105.5 since end-June. Brent Crude doing the same at $108. Pause for breath like FX or ceiling?

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Aussie Westpac leading Index Growth slowed

- China Actual Foreign Direct Investment Much better

- China Conf Board Leading Econ Index Improved

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Derwent London launches 150 mln stg bond offering

- Balfour Beatty in 70 mln stg water contract extension

- Severn Trent trading in line with expectations, incurs 19 mln stg bid costs

- Fresnillo says silver output on track, lowers gold target

- Telecom Plus first-quarter customer numbers rise 11 pct

- Imperial Innovations says chief exec Susan Searle steps down

- Electrocomponents reports marginal rise in first-quarter sales

- Cello says seeing more income coming from outside UK

- Smiths warns year profit to be 15 mln stg below expectations

- Miner Hochschild trims board, directors’ salaries