Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

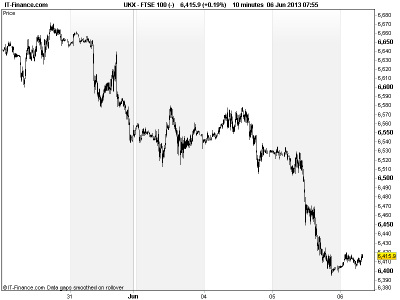

UK 100 called to open -20pts at 6410 after another mixed session in Asia and negative US close, although we note futures finding a modicum of support around 6400 overnight. Could this be where the 7% correction halts, or does the clear-out still have legs?

Asia mixed overnight on global growth concerns (China sparring with Europe) and persistent QE3 tapering fears (Fed Member speak, data) as well as the IMF’s mea culpa on Greece’s bailout with too optimistic assumptions and it not meeting the criteria required. If it was so wrong on Greece, how wrong was it on Ireland, Portugal and Cyprus?

US weak after the ADP employment change (Non-Farm Payrolls warm-up) missed expectations, US Factory Orders were worse, and the employment component worsened within a better US ISM Services. While this should have buoyed hopes of continued QE, there was enough good data out there to offset, perversely doing more harm than good.

Growth-wise, after the upbeat reading on the US services sector (>75 of GDP) the US Beige book showed ‘modest to moderate’ growth across most of the county and all 12 districts reporting ‘moderate to strong’ expansion in housing. Markets worried still swaying back and forth trying to work out whether it should focus more on growth or employment for signals on QE3 withdrawal, or whether the two really do go hand-in-hand.

Note that good UK data on Services and government initiatives helping with the housing market unable to perk up sentiment, with focus still on the global outlook (Europe GDP, Retail Sales and PMI Services weak) especially with the key Non-Farm Payrolls (the data the Fed is looking at) out tomorrow.

Australia weak after a smaller Trade surplus due to less exports and more imports seeing the AUD/USD fall to a new 20-month low. Japan toying with breakeven, swaying the JPY and Japanese bonds similarly.

In focus today will be the UK and EZ central banks although no policy change is expected at either, the ECB press conference being the interesting event with potential insight into what the bank is willing to do in terms of rates and unconventional policy, notably via the Q&A. German Factory Orders seen weak in April after a strong March. US Jobless Claims complete the line-up for the day, seen flattish.

UK 100 still in correction, although found some support overnight around 6400. Difficult to know whether this is where the declines halt or whether this is further to go, although after the fall of the last few days a pause before NFP wouldn’t be out of the question especially the ECB provides no surprises.

In FX, GBP/USD still benefiting from US uncertainty and above 1.54 and EUR/USD now well above 1.31. Note USD/JPY found support at 99.

Gold back below $1400 despite weak USD, still struggling to find direction/traction. US light Crude found resistance at 1-month falling highs around $94. Same for Brent Crude, although it is now well off its highs of $104, trading $103.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Aussie Trade Balance Worse

- French ILO Unemployment In-line

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- KKR buys UK retail park property portfolio

- Falkland Oil and Gas says completes 3D seismic survey

- Geopark says moves latest Colombia find to production

- Regal Petroleum continues with upgrade to processing unit

- EasyJet May passengers up 3.4 pct

- BATM Advanced Comms warns on first-half profit

- Filtrona to be renamed Essentra

- Ultra Electronics buys Varisys for intial 16 mln stg

- Alliance Pharma buys Syntometrinetm rights from Novartis

- Johnson Matthey profit drops 9 pct, sees steady progress

- Alliance Pharma buys rights to Novartis’ obstetric drug Syntometrine