Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

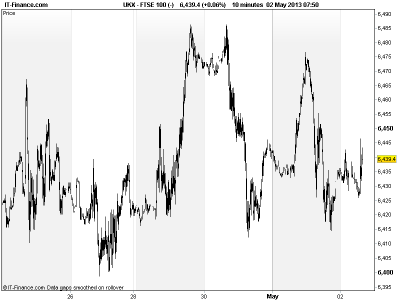

UK 100 called to open flat despite Asian indices moving lower following a negative lead from the US as news that the Fed would increase accommodation if necessary was unable to boost appetite for risk/help investor confidence after the weak global macro data of late, confirming that growth outlook was very much uncertain, but not as dovish as expected.

Overnight global sentiment also dented by another weak number out of China, with the HSBC Manufacturing PMI missing expectations, like the official figure yesterday, with new export orders falling for the first time this year.

A plunge in Aussie building approvals also suggests falling confidence down under and will lead to increased calls for a rate cut in early May (watch AUD for weakness). No surprises from BoJ April minutes, and persistent JPY strength denting Japanese equities.

Incoming BoE governor Carney gave a lecture on the future of monetary policy and said it may be desirable for central banks to allow above-target inflation for longer which, along with stimulus, can help with economic weakness. Said QE showing positive effects

In focus today – final Eurozone Manufacturing PMIs which are seen confirming contraction across the region reiterating the effects of austerity. UK Construction PMI also seen weak, albeit less so than last month. US Jobless and Trade Balance seen stable.

In the afternoon the ECB updates on interest rates with the expectation (very much priced in) that Draghi will cut 25bps from the headline rate in an effort to help growth in the region. As stated previously though, with a broken financial transmission mechanism we are sceptical that any benefit reaches those who really need it, notably in the periphery.

UK 100 trading sideways in very narrow range. A surprise from ECB may be what’s needed for breakout (either a bigger cut or no cut at all) after Fed announce had little effect at all.

In FX, GBP/USD back off bets levels of 1.56 as Fed stayed neutral, leaving the door open to both increases and tapering of QE3 but not as dovish as expected. Although the addition of ‘increased’ to the statement suggests concerns over growth. EUR/USD also off its best levels of 1.324 with the expected USD weakness from Fed not materialising and so the onus moving to the EUR and the ECB action today to move the pair.

Gold off its worst levels of $1440 but unable to regain highs of last few days $1480 as Fed went neutral on QE3 (might increase, might decrease). But the simple expression of concerns over growth by allowing for increasing asset purchases did see a small bounce. Nonetheless, with inflation still not a concern, Gold less in demand as a hedge and so unable to advance.

Oils off their worst levels following US ADP Employment disappointment and growth concerns, helped a little by Fed statement but unable to gain any traction, with US Light Crude falling back below $91 and Brent Crude falling back sub-$100 overnight.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Japan Monetary Base Improved

- Aussie Building Approvals Worse

- China HSBC Manufacturing PMI Worse

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Gulf Keystone set for Significant Production Growth

- Glencore seen still hungry after swallowing Xstrata

- Millennium and Copthorne Hotels Q1 profit falls

- Countrywide Q1 income down 1 pct

- Legal and General Q1 sales rise 28 pct

- RSA posts higher net asset value as premiums rise

- Schroders Q1 profit up 20 pct on retail demand

- James Fisher says trading in line

- Lancashire Q1 pretax profit $78.9 mln versus $46.5 mln

- Galliford Try wins Manchester deals worth 36.5 mln stg

- Regus posts 18 pct rise in first-quarter revenue

- BSkyB adds 550 jobs to meet strong demand

- Smith & Nephew plans $300 mln share buyback

- Imagination Tech warns on profit on licensing delays

- Sage completes non-core disposal

- BG earnings dip 3 pct on lower production, costs

- Trap Oil acquires further stake in North Sea licence

- Rolls-Royce on track for further profit growth in 2013

- Howden Joinery trading in line with expectations

- Carillion preferred bidder on Liverpool

- BATM confident on 2013 revenue growth

- RPS Group sees first half similar to 2012

- Avocet Mining sticks to full year guidance

- Shell boss to retire next yr as Q1 beats profit forecast

- Randgold Q1 hit by lower sales, reduced production at key mine

- Inmarsat says hit by U.S. Government budget cuts

- Lancashire Holdings 1st-quarter profit rises 70 pct