Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

UK 100 called to open +15pts, with Asian markets making a strong turnaround after the weakness passed on from Europe and the US due to worries about Europe (Spain in particular) intensifying and concerns over global growth remaining to the fore after weak US home sales.

Sentiment boosted overnight by news that the Chinese central bank PBOC (People’s Bank of China) pumped even more money into the interbank market, taking weekly intervention to record highs, highlighting how it is prepared to, and is acting when necessary to help its flagging economy.

This overrode the existing standoff between China and Japan about disputed islands, where China said it would make Japan’s trading conditions with it grim and the latter’s PM Noda saying he would not compromise (just when the US and Europe could do with Asia helping out with global growth, they are scrapping in the playground over conkers, metaphorically speaking).

Adding to the negatives, China Industrial Profits fell again in August even more quickly than July, and Credit Suisse cut its 2012-13 China growth forecasts, while South Korean Business survey took a leg down.

Back to the eurozone pantomime, and it’s all about Spain. Protests have intensified ahead of today’s budget with austerity already biting hard. It’s unlikely to have much upside surprise potential, with the numbers set to show how this year’s deficit will miss targets meaning next year’s will probably miss too.

After multiple downside revisions, figures will also still be taken with a fistful of salt, at a time when the European powers that be (and neighbours) will want to know that they are not throwing good money after bad. Spain can also be substituted for Greece, where the situation is similar with protests ahead of proposed budget cuts needed to receive the next tranche of aid.

While the Spanish budget is one thing today, the results of the nation’s banking sector stress tests are also key so we know how much they need in order to be recapitalised. This is because, as it stands, the aim is for the new bailout fund to stump up the money to avoid the sovereign taking on more debt. However, Germany and certain peers have been suggesting this idea only apply to ‘new cases’ further down the line. One step forward, two steps back.

Add to this regional unrest in Spain regarding autonomy and potential independence, and a potential ratings agency downgrade (Moody’s) and we have the all makings of a rekindling of uncertainty, efficiently undoing the summer’s central-bank (ECB and Fed) induced rally.

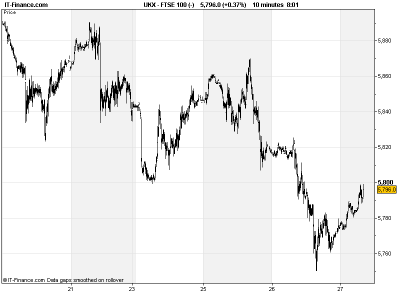

The UK 100 has thus fallen back to the levels we were looking for (around 5,760 September lows and 3-4 month rising support), and we have seen a recovery by futures overnight. However, 8-day trendline of falling resistance, remains a hurdle to jump at 5,850 if the 3-4 month upside trend is to be considered still alive. If all the bad news is priced in it’s possible, but as we’ve seen worries can easily intensify quickly. Dead-cat bounce?

The macro calendar is a bit fuller today, with UK final Q2 GDP expectations of no change from last reading of -0.5% on Q1. An upward revision is always possible, but it’d need to be chunky to make a big difference to existing contraction. The US final Q2 GDP reading is also seen unchanged at 1.7% over the year, meaning more focus on Durable Goods orders which are seen down a significant 5%, at odds with the strong Consumer Confidence and Fed Manufacturing figures of late. US Pending Home sales will be looked for any different message from yesterday’s week New Home Sales figures. US jobless likely to remain as stagnant as ever, and Final September Eurozone Confidence data seen pretty much unrevised.

In commodities and FX, Gold has rebounded on the risk aversion and weakening of the USD versus GBP and EUR (QE3 debasing stronger than safe-haven seeking). Oils also bounced but still in downtrend from mid-month, however, Brent crude shows a bit more buoyancy on geopolitical drivers.

For any other help you may need, be it market information or assistance with trading, make sure you speak to our trading floor.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Aussie Job vacancies Growth

- China Industrial Profits Faster decline

- Germany Import Prices Faster growth

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- TUI Travel sees in line FY, winter 2012/13 trade good

- Compass to cut back in southern Europe

- AIA to buy Aviva’s Sri Lankan unit in $109 million deal

- Cosalt agrees to settle legal case against Melvilles

- Petrofac wins $200 million project in Kuwait

- Penna Consulting sees year outcome in line

- Cloud computing firm Iomart expects to beat market view

- ICAP Shipping buys CTI Shipbrokers India

- Nationwide Accident says H1 in line

- Vodafone outlines costs, synergies of C&W buy

- 3i Infrastructure says European assets performing well

- German minister thinks more time needed for EADS/BAE talks

- Tate & Lyle sees flat H1 profits with H2 to improve

- Aker Solutions wins $400 mln Shell contract in Brunei

- BHP says sees China’s growth strengthening in H2