Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires

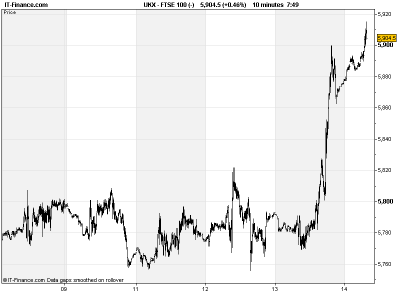

UK 100 called to open +90pts, reaching 4-month highs, after the US Federal reserve (Fed) last night pleased markets by announcing the third round of quantitative easing (QE3), something sought by traders for several months. This involves the purchase of $40bn of Mortgage Backed securities (MBS), on top of existing US Treasury Bond purchases, in order to bring down long-term borrowing costs and hopefully boost growth (forecasts for which Chairman Bernanke also reduced). Interest rates will also stay lower for longer.

Most important of all, however, is the fact that the new programme is open-ended ‘until we see improvements in the labour market’ (unemployment rate), even when the economy starts to recover, with no rush to reverse. The Fed has thus tied policy to a specific piece of economic data which likely removes some of the recent waiting and market volatility surrounding expectations of Fed stimulus announcements in the face of conflicting macro data.

Without improvement, more may also be done which should also please market participants. On the flip-side, the Fed seems likely to tolerate a slightly higher inflation rate (weaker US Dollar traditionally means higher commodity prices on improved demand) which could choke consumption and thus unemployment, and which bears may pounce on as a negative.

Last night’s announcement has added to existing positivity: European Central Bank (ECB) president Draghi proposing to help troubled European nations borrowing costs (Outright Money Transactions – OMT); German constitutional approval (albeit with conditions of the new European bailout fund, European Stability Mechanism (ESM) and fiscal pact which allows Draghi to offer his assistance; pro-European Dutch election result.

With expectations high for QE3 denting the USD and Draghi’s late July pledge to do ‘whatever it takes’ benefiting the EUR, the EUR/USD pair has been rising since late July and last night’s announcement sealed the pair’s breach of the 1.30 level (4-month highs). The USD is also week against Sterling (GBP), with GBP/USD now above now above 1.62 level (4-month highs)

Overnight in Asia, risk appetite highs as might be expected following the Fed announcement and 1.5% gains recorded by US equities. Macro data from Japan showed a slight improvement in Industrial Production weakness and Capacity Utilisation.

Other bubbling issues remain hopes that China announces its own stimulus measures and whether Spain will request assistance to allow Draghi to implement his new assistance measures. Both Spain and Italy seeing sovereign borrowing costs continue to benefit from the Draghi backstop, but many sceptical that this means Spain can escape a bailout.

Watch out today for the Eurozone finance ministers meeting in Cyprus (market-moving comments likely on Spain/future of Eurozone/European banking union). On the macro data front, Eurozone consumer inflation seen unchanged over the year. US consumer inflation seen a touch higher (and likely higher again next month after QQE announcement) while US Retail Sales should have maintained a similar growth level to last month.

In Commodities, Gold higher on Fed’s QE dollar-weakening, growth and inflation boosting announcement, hitting highs of $1,778, near February highs. Oil (US Light Crude and Brent) benefited for the same reason, with Brent also helped by geo-political issues.

Should you require any other help on what’s moving the markets, speak to you friendly trader.

Overnight/Weekend Macro Data: (Source: Reuters/DJ Newswires)

- Japan Industrial production Weak, but less weak

- Japan Capacity Utilisation Improved

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Wetherspoon’s profit up, new FY helped by Olympics

- RBS confirms plans to float Direct Line business

- Carlyle gets Chemring bid deadline extension

- Domino Printing sees FY sales steady, says market fragile

- Magnolia Petroleum Participates in Bakken Well, North Dakota

- InterContinental Hotels to Pay $1.72/Share Special Dividend

- Ithaca Energy Update on Athena Field P1 Operations