Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

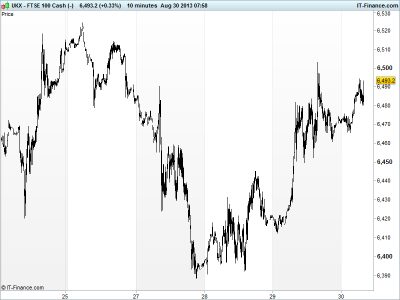

UK 100 called to open -5pts at 6485 despite a positive close in the US and a largely positive session in Asia as markets took relief from a preliminary UK no-vote on entering Syria (public fears of a another Iraq), delaying any expected coordinated and aggressive military intervention, even if the US may still opt to go it alone without UN approval.

US markets also reacted more positively to a bigger than expected upwards revision to Q2 GDP, despite the better growth bringing the reality of tapering a step closer (the Fed will have to move now, surely, to retain credibility). The stronger USD helped bring the price of commodities like oil further back from their recent Syria spike as did the delay in military intervention which had been a concern in terms of potential contagion and supply disruption in the Middle East.

Japan the only major in the red in spite of overnight geopolitical developments and improved PMI Manufacturing after inflation data (biggest rise since 2008) increased the possibility of a sales tax hike. Note fuel and food price rises likely helping inflation, along with weaker JPY, so a sales tax hike could still scupper the very much consumer-led recovery. Household spending and Industrial Production didn’t rebound as much as expected and housing cooled.

Other macro data included positive prints for UK Consumer Confidence (near 4yr high), Aussie Private Sector Credit, Chinese MNI Business Sentiment and UK House Prices (still very strong), with German Retail Sales the only blot, showing more contraction in Jul. Note the strong UK housing data which has been worrying some in light of government initiatives fuelling a bubble, has seen the BoE’s Carney say he still step in to prevent this happening.

In focus today will be UK lending data and mortgage approvals for signs of continuing consumer confidence and buoyancy in the all-important housing market (see above, bubble). In the Eurozone, business sentiment indicators are seen continuing to improve, in-line with recent economic data, while unemployment is seen staying worryingly high and inflation ticking back adding to demands for an ECB rate cut, especially after Germany unemployment yesterday and retail sales this morning.

In the afternoon, GDP updates from India and Brazil are expected to show slightly slower growth for the former and acceleration for the later, providing more insight into emerging markets which still being looked to as the developed markets recovery slowly. Thereafter it’s US Personal Income and Spending which are seen cooler in Jul, offsetting the stronger GDP revision yesterday while the Chicago PMI and Uni Of Michigan are seen edging higher.

UK 100 made some ground yesterday to retest 6500 however failure to trouble it leaves the trend of falling highs from the beginning of the month intact. Support at 6450 lows of yesterday, then 6415 rising lows. Week-end and month-end, taper-positive US data and Middle East uncertainty may keep a cap on sentiment.

With Geopolitical tensions still simmering after a tough month-end week where focus shifted from Fed tapering, note that the weekend may still provide much important news and decisions with weapons inspectors leaving Syria on Saturday. Monday could again be a volatile one. Beware.

In FX, USD Index breakout made it to 82.0 helped by stronger US GDP data, although it is just off its best levels. 82.5 possible as demand for the greenback returns and begins to move in the direction one might assume given the prospect of September tapering of Fed stimulus.

GBP/USD remains under pressure after dovish tone by Carney and stronger US data. Falling trend from 21 Aug, but support still from 2013 major falling trendline and 200-day MA. EUR/USD declines slowed up at 1.325 although downside to 1.32 August lows still possible as USD strength outweighs Eurozone optimism.

In Commodities, Gold found support at $1400 but maintains uptrend from early August but off its best levels of $1435 on delayed Syrian intervention. Upside still possible to confluence of resistance trendlines around $1500.

Oils’ well off their best levels on less reduced prospect of supply disruption and stronger USD from US GDP revision. US Light Crude bounced off $107 and Brent off $114, the latter still holding up better.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- UK GFK Consumer Confidence Beat

- JP PMI Manufacturing Improved

- JP Household Spending Miss

- JP Jobless rate Beat

- JP Consumer Inflation In-line

- JP Industrial Production Miss

- AU Private Sector Credit Beat

- CN MNI Business Sentiment Improved

- JP Vehicle Production Improved

- JP Housing Starts Miss

- JP Construction Orders Deteriorated

- UK Nationwide House Prices Beat

- DE Retail Sales Mixed

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- AT&T eyes Vodafone post Verizon deal

- Restaurant Group first half profit up 15 pct

- United Drug buys healthcare marketing unit for C$15.5 mln

- Sefton Resources says CEO to step down

- Mwana Africa announces cost cutting measures

- Computacenter H1 loss before tax 4.3 mln stg

- Perform Group on track to deliver strong FY earnings growth

- Bwin.party expects full-year revenue slump