Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

UK 100 called to open -5pts, with Asian bourses mixed (off their lows), Japan the positive outlier and rebounding from -2% to 2% after BoJ finally delivered aggressive monetary easing (quantitative and qualitative) announcement markets had been expecting after installation of new dovish leadership. JPY stronger vs. USD and Nikkei equities higher.

Elsewhere in the region, equities in Australia and Hong Kong held back, with Japanese QE news unable to offset concerns emanating from the Korean peninsula, the severity of the situation upgraded after the US stepped up local defences.

US markets closed lower after disappointing US data (ISM, ADP) cast doubt over the pace of recovery and Fed chatter was helpfully mixed. With US futures called higher this morning, despite talk of tapering QE on more positive outlook, could expectations of growth finally be trumping the markets addiction to easy policy?

In focus today, Central Banks set to dominate the agenda with the BoE and ECB delivering policy updates today. While no changes are expected from either, at the latter’s press conference, Draghi’s comments will likely be analysed closely following the Cyprus bailout and with regional macro data remaining weak (rate cut hint?).

Data-wise, after the weak PMI Manufacturing data from across the world, Europe updates today on the Services sector where PMI readings are seen remaining thoroughly depressed (excl. Germany). In the afternoon, updated Weekly US Jobless claims are seen flat on last week.

Fed Chairman Bernanke also speaks, and with all the recent talk of QE tapering, markets will also be listing keenly to what he has to say, especially on the employment front ahead of tomorrow’s Non-Farm Payrolls (NFP).

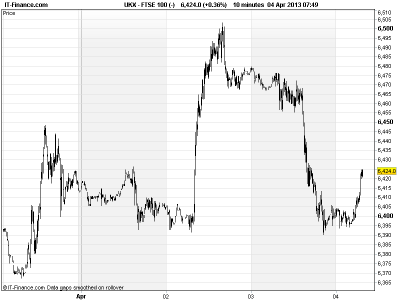

After the UK 100 ’s sharp pullback yesterday support emerged at 6390, Tuesday’s lows, and we’ve bounced following the BoJ announcement. This is above the lows of the Cyprus fortnight which suggests risk appetite still hanging around, although the break back below 6460 could mean that resistance has built up around the 6460-6500 level following the raft of disappointing macro readings.

As pointed out yesterday, Gold’s weakness on prospect of QE tapering and more positive US outlook has been helping USD (despite Korea worries) and displaying possible bearish flag pattern with downside to $1500. Already back at $1550, levels last seen in July last year.

In Oils, US light Crude sold off sharply to $94.5 on news that US stocks had risen to a 20-year high, while Brent Crude fell back to end-March lows of $107. Both have seen their uptrends undone.

In FX, GBP/USD back at levels of this time yesterday as the Greenback strengthens vs Sterling on the prospect of QE tapering. Mid-March support around 1.5075 could come back into play today (supportive yesterday), while resistance remains at 8-day highs of 1.525. As for EUR/USD, it has managed to hold above 1.28 but had found resistance at 1.285 again. Very shallow rising lows around the 1.28 level.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Japan BoJ Interest Rates Unchanged, as expected

- Japan Monetary Easing Sales Aggressive

- Aussie Building Approvals Beat consensus

- Aussie Retail Sales Beat consensus

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Booker Q4 like-for-like sales rise 2.2 pct

- Kcom trading in line, reaches pension deal

- Domino’s Pizza shakes off snow to push Q1 sales up

- Barclays decreases tender cap for cash tender

- BTG says delivered a strong financial performance

- Vodafone adoption of new reporting standards

- British Land buys Tesco’s stake in East London shopping centre

- Cranswick underlying sales up 5 pct in the year to 31 March 2013

- AMEC maintains guidance, trading in line

- Printing.com says trading still difficult

- HSBC sells quantitative techniques operations to Euromoney