Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

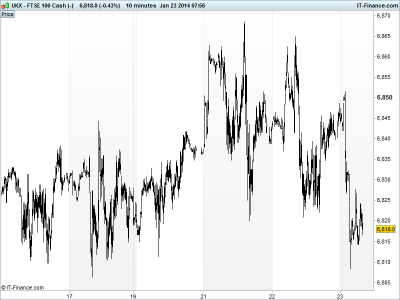

UK 100 called to open -10pts at 6820, with overnight sentiment taking a slight knock (less than expected) from a worse than expected Chinese HSBC/Markit PMI Manufacturing reading, falling into contraction for the first time in 6 months and increasing worries about slowing growth.

Asian bourses in the red following the China data miss, with Australian equities also impacted by a rise in consumer inflation expectations, following hot on the heels of the yesterday’s inflation data which removed rate cuts hopes and despite a retrace in AUD strength.

US markets closed mixed, as they have done for several days now, with limited macro data offset by good Q4 results from the likes of United Technologies, General Dynamics although Motorola Solutions disappointed by warning on Q1 revenues.

After the US close, eBay results were well received and the shares put on over 8% after hours, although this was also to do with activist investor Icahn (he who keeps criticising Apple for having too much cash) calling for a spin-off of PayPal. After-market results from Netflix also beat with upbeat subscribers and outlook helping shares surge.

At the Davos World Economic Forum, a speech from Japan’s MP Abe said the country was on the verge of emerging from the crippling era of deflation with GDP growth positive and reforms working.

After the European close, note Spain smashing a record for European sovereign debt demand with orders exceeding 4x for the €10bn 10yr offering highlighting appetite for yield hungry investors and interest in peripheral Eurozone paper.

Overnight ECB President Draghi cautioned against undue optimism and risks of Eurozone recovery setbacks, while saying he was not worried about inflation or deflation and said plenty of instruments to ensure price stability; i.e. ‘still prepared to do whatever’.

After UK unemployment data fell so sharply yesterday, and so close to the BoE’s 7.0% threshold for ‘considering’ a rate rise, MPC member Mcafferty says more will be said on guidance when the threshold is hit (data lagging, possibly already hit) suggesting the February quarterly Inflation Report, just after Feb labour market data could be one to put in the diary.

In focus today, we have preliminary PMI Manufacturing and Services readings from France, Germany and the Eurozone with France seen marginally improving but remaining in contraction. German growth/strength seen holding and keeping the region’s reading buoyant. After Spain did so well in the sovereign debt markets, France will be watched this morning.

UK CBI data will be keenly watched after the very strong official UK December Retail sales readings. Supportive or not? US PMI Manufacturing seen improving a touch to a German-like print. UK House prices seen still rising in November, while Eurozone consumer Confidence to improve only slightly and US Existing Home sales solid in December.

Results continue with Nokia mid-morning, McDonalds and South West Airlines before the US market opens and then Starbucks and Microsoft after the US close.

UK 100 futures encountered a bit of weakness overnight, failing at 6850. The drop on the China data has tested the 6820 level and ventured as far as 5-day lows of 6805. Watch for this level to hold. If so, we should be able to regain recent highs. If not we could revisit 6775.

In FX, the USD index remains in the 81.1-5 range. GBP/USD up above 1.655 and close to end-13 highs of 1.66 on yesterday’s strong UK unemployment data. EUR/USD still in 2014 downtrend, but mild bounce off 1.35 continues. USD/JPY still stuck in 104-105 range. AUD/USD back down near recent lows of 0.88 on China data, reversing yesterday’s strength.

Gold fallen back below $1240 and almost tested $1230. Rising lows from 8 Jan breached meaning $1250 could become resistance again. Hindered by USD holding its strength and absence of fear and thus safehaven demand.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- US eBay & Netflix Q4 Results Beat

- AU Consumer Inflation Expectations Increased

- CN HSBC/Markit PMI Flash Manuf Miss, deteriorated

- CN Conf Board Leading Econ Index Improved

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Kenmare says expanded Moma plant commissioned and in operation

- London Stock Exchange – Q3 income up 48 per cent at 308.9 million STG

- United Carpets no longer part of OFT pricing review

- A.G.Barr sees FY revenue up 6.1 pct

- Shire says Susan Kilsby to succeed Matthew Emmens as Shire chairman

- St. James’s Place assets rise to 44.3 bln stg

- Russian retailer X5 sales growth picks up in Q4

- Pearson says U.S. weakness to hit 2013 earnings

- SSE to cap energy prices until 2015

- Moneysupermarket.Com appoints Bruce Carnegie-Brown as chairman

- Aviva says CFO Regan to leave

- IP group to buy Fusion group in all-share deal

- easyJet sees H1 seasonal losses higher than last year

- Russia’s Petropavlovsk sees 2014 gold output down

- Kentz says diluted earnings per share for 2013 in line with expectations

- Petra Diamonds sees “exceptional” blue diamond boosting second half

- Hi-tech material firm AZ says Merck’s offer extended to Feb. 5