Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires

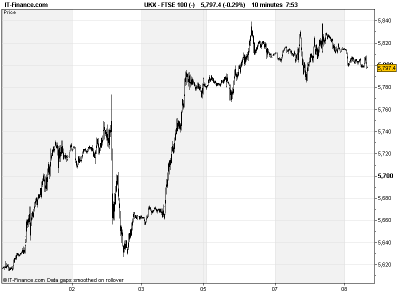

UK 100 called to open -15pts, although this includes an ex-dividend impact of around -25.4pts from several big names including AZN, BARC, BT, GSK, RDSA, SAB, STAN, ULVR and BP. Asian markets posted another positive session, with resources stocks leading on renewed optimism on the global economic outlook and hopes of monetary stimulus from China. Only China opted out of the party ahead of a slew of economic data points tomorrow (Industrial production, Inflation, Producer prices, Retail Sales). Chinese inflation seen slowing, boosting case for stimulus to restart the economy.

US markets closed higher with continued hope that more stimulus is on its way from the world’s major central banks (China, US, ECB) and some positive corporate results. The US major index S&P 500 broke out above 1,400, a level not seen since May. US Federal Reserve Chairman Bernanke provided nothing new in a speech. Talk of Spain refusing to ask for bailout if new conditions added to what it is already doing.

Ratings agency S&P reared its ugly head by lowering Greece’s long-term rating to negative from stable, confirming CCC/C rating but saying downgrade possible if next bailout instalment is not received. Austerity is biting hard. Club-Med are you watching?

Overnight data showed Japan posting a wider than expected current account surplus, although its trade balance was a touch light (although improving significantly from huge deficit). Eco-watcher surveys from Japan were also better than expected. Closer to home, Germany has just published better current account and trade balance data thanks to a imports falling faster than exports, although falling exports is not what Germany needs as an exporting nation, and highlights slowing world demand .

In commodities, Gold continues to peter back towards the $1600 level, although still well above its recent lows of $1,585. Silvering following suit, but support could emerge around $27.80. Oil has continued to rally, with Brent Crude rising >$110 (May highs) from a North Sea shortage. US Light Crude shows similar pattern. In FX, GBP off worst levels vs EUR. GBP weaker vs USD (broken rising support) ahead of BoE inflation report. EUR weaker vs USD, but support possible at 1.235

Today’s focus likely on UK’s Bank of England (BoE) inflation report which is expected to show the bank’s economic growth targets being slashed yet again. Having forecast growth of 0.2% in Q2, the recent Preliminary GDP figure came out at -0.7%, hit by extra bank holidays and bad weather. The negative knock to 2012 expectations on is surely unavoidable. Growth at all? Inflation may, however, show continued improvement thanks to lower commodity prices.

Elsewhere, Germany’s Industrial production will be watched to see if it was as weak as the country’s Factory Orders data yesterday. The nation is also auctioning €4bn of benchmark debt (10yr) which, as a safehaven of Europe recently benefited from having to very low borrowing costs. Same again?

Corporate results out this morning from miner Rio Tinto (RIO) which looks to have beaten Q2 earnings per share expectations. Old Mutual (OML) and Cobham (COB) however look to have missed. As ever, the devil is often in the details, and believe me there are pages of details. For more information call in to speak to your friendly trader.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Japan Current Account Better

- Japan Trade Balance Worse

- Aussie Home Loans Worse

- Japan Eco-Watchers Surveys Better

- Switz SECO Consumer Confidence Worse

- Germany Current A/C, Trade Balance Better

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Cobham first-half adjusted profit slips

- Old Mutual H1 profit up 12 percent

- Avon Rubber sees H2 results stronger than H1

- Rio Tinto 2012 half year results

Morning Press Selection: