Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

UK 100 called to open -15pts, with a mixed session for equities in Asia, with weakness in Japan’s Nikkei being rescued to just above breakeven by (surprise, surprise) comments from the Economy minister clarifying his comments regarding the Yen (JPY) and negative consumer impact from weakness, saying the currency is still in a correction from previously excessive strength. Having rebounded yesterday, the USD/JPY took another leg higher benefiting exporters yet again.

Elsewhere in the region, stocks in China again underperforming ahead of the key data releases tonight (2am) including the keenly watched GDP, Industrial Production and Retail Sales which may see today’s European/US trading continue its consolidation phase and after the recent strong rally, with more evidence from the #2 world economy awaited for evidence on global growth situation.

Overnight data included stronger than expected Australian Consumer Price Inflation (CPI) which increased calls for a rate cut to maintain growth in the economy and hit the Aussie dollar versus the greenback (AUD/USD). Employment data from down under also showed an increase in unemployment hinting at economic struggles and backing up rate cut calls.

With news from Europe’s crisis heart Greece a bit thinner since moving into 2013, the International Monetary Funds’s (IMF) Chief Lagarde says aid programme going in right direction after agreement to disburse next tranche, but need to keep focused on structural reforms (banks, tax) at home and regional partners remain supportive. Portugal’s next tranche also approved.

In the US, markets again stuck around neutral despite strong results from banking giants JPMorgan and Goldman Sachs beating expectations. Comments from Fed members suggest on the one hand QE displaying diminishing returns but on the other it must continue. Elsewhere, after positive Industrial and Manufacturing production readings, the Beige Book showed modest economic growth (recovery post Superstorm Sandy) despite fiscal cliff, but decisions on tax spending and general fiscal uncertainty still weighing on sentiment.

In focus today will be the Eurozone Construction print which was weak in October as austerity weighs. Thereafter, US updates on Housing will provide more gauges on consumer confidence with consensus expecting an improvement. The Philadelphia Fed is also seen creeping up.

Aside macro data, we have more Q4 results numbers from the US financials/banks, with Blackrock, Bank of America, Citigroup before the US markets open, and then tech giant Intel after the close. With the muted market rally after Goldman and JP yesterday, can these names reignite the market advances or is global growth uncertainty just too much.

Company-wise, keep an eye on Boeing’s woes from the 787 dreamliner weighing on the US indices, and news from London-listed mining giant Rio Tinto of huge write-downs and the resignation of its CEO.

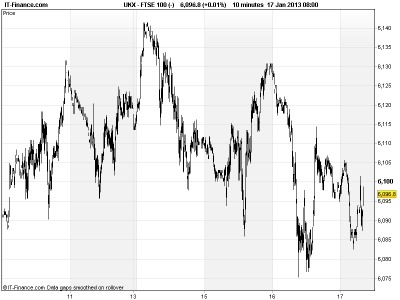

The UK 100 remains under pressure and with the falling and widening channel from Monday still in play. Note however some support at 6080 rather than continued falling lows. With falling highs since midday yesterday, however, pressure remains and the 6100 level has again become important.

In FX, GBP/USD fallen below 6-month rising support at 1.60. Change of trend confirmed? Downside to November lows at 1.585? EUR/USD, still below 1.33 but stable after pullback from 1.34 highs on comments EUR too strong. GBP/EUR still stuck below 1.20 after breakdown below trendline of falling lows on above EUR comments.

In Commodities, Gold tried higher but found resistance around $1682 making falling highs and resistance from Tuesday night’s highs of $1685. Still in tight $10 range. In Oil, US Light Crude stable around $94 despite USD strength, although with clear resistance at $94.5. Keep an eye on Chinese data tonight which could impact global growth expectations and thus commodities demand. Brent Crude struggling to regain $110 level although in tight 24 hour range after pullback from $111.5 Tuesday highs.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Aussie CPI Increased

- Aussie Employment Change Worse

- Aussie Unemployment rate In-line, but higher

- Japan Nationwide Dept Store Sales Deteriorated

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Rio Tinto CEO to step down after $14 bln charge

- Land Securities increases stake in X-Leisure

- Petropavlovsk says IRC to receive investment, FY output beats

- Dixons UK sales rise partially offset by southern Europe fall

- Aberdeen says net new money in Q4 hits 1.1 bln stg

- Home Retail lifts profit expectations after Argos sales rise

- Computacenter says 2012 results to be ahead of expectations

- ASOS Christmas sales rise 41 percent

- Premier Oil sees output rising in 2013

- Hammerson and Westfield enter JV to redevelop Croydon retail centre

- Primark sales rise drives AB Foods revenue higher

- Premier Foods sees results in line with forecasts

- NCC says on course after 6 pct H1 profit rise

- African Barrick Gold production drops 9 pct in 2012

- Mothercare posts 5.9 pct fall in UK like-for-like sales

- Stobart expects FY op performance to be slightly below current market expectations

- Booker Q3 like-for-like sales up 3.1 pct

- Wood Group wins $50 mln contract with Nexen UK

- SDL sees results broadly in line with forecasts

- Afferro Mining says remains in offer talks

- Dixons Retail CEO says sold “well over 1 mln” tablets in Q3 period