Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

UK 100 called to open +15pts (ex-divs -2.9pts) despite weak macro data from Chinese PMI Manufacturing overnight and weaker than expected UK House Price Data this morning.

Significantly weaker Australian manufacturing data also begs the question as to the knock-on effect from a potentially slowing China. Positive start also in spite of many European markets being closed for the 1 May Labour Day holiday.

A quiet session in Asia, with many markets closed for public holidays (Golden week). Japan and Australian in the red after continued JPY strengthening and mixed data, respectively. Speculation increased as to RBA announcing rate cut next week to help boost economy.

Weak Chinese data dented sentiment as to potential or world’s #2 economy can help with global growth momentum (HSBC PMI Manufacturing figure released tomorrow).

US markets closed positive despite mixed macro data (good housing, poor Chicago PMI, better consumer confidence) providing little help as to economic outlook, but expectations remain that Fed maintains its asset purchase programme this evening helped S&P500 to new high. Appetite for Apple’s mammoth $17bn bond sale also added to general stateside optimism.

US higher, despite Europe closing in the red following poor Eurozone unemployment and inflation data which added to calls for an ECB rate cut tomorrow. New Italian PM Letta survived second confidence vote confirming grand coalition into power and Cyprus approved bailout (just, however, Moody’s cut potential next domino Slovenia to junk.

In focus today will be the UK’s own PMI Manufacturing which is seen remaining in contraction territory, albeit up from last month. In the afternoon, US ADP Employment change may serve as a US Non-Farm Payrolls warm-up act, with another 150K jobs seen added in April. US Construction Spending seen growing, albeit slower, while ISM data is expected to remain in growth, but to have ticked back in April.

The big event though is this evening with US Fed’s FOMC rate decision and statement. No rate change expected but statement expected to be dovish given weak data-points of late feeding appetite for loose monetary policy and helping risk assets. However, weak data also leading to more questions as to efficacy of current unconventional policy (global) and whether it is the market saviour it is made out to be.

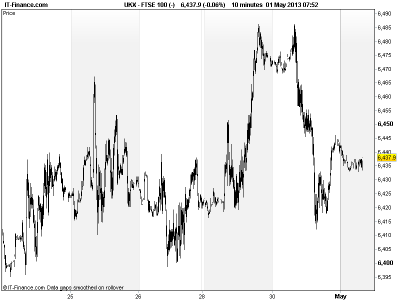

UK 100 still above 6400 with a test and fall-back from near April high of 6500. Markets may be quiet today due to European holidays which may mean sideways 6400-6480 range and wait-and-see ahead of Fed statement tonight and maybe even the ECB decision tomorrow.

In FX, GBP/USD rallied to above 1.55 on expectations of Fed’s dovish statement this evening confirming QE here to stay to help boost economic growth. EUR/USD also rallied with expectations of Fed keeping QE outweighing prospect of ECB cutting rates. Potential resistance at mid-April highs of 1.32. Support 1.31.

Gold found resistance at $1480, despite USD weakening vs. peers. Potentially taking pause for breath after recovery from 2yr lows of $1321. Another leg up possible? Central bank meetings could dictate yellow metal’s direction.

Oils seen US Light Crude trade back from $94.5 to below $93 on worries over global economic growth. Potential support $92.5 prior lows. Brent Crude dropped below $102, with potential support at prior highs $101.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- Aussie AIG Manufacturing Perf Contraction

- Aussie House Prices Contraction

- China Manufacturing PMI Worse, growth slowing

- Aussie Home Sales Rebound

- Japan Labour Cash Earnings Better

- Japan Vehicle Sales Rebound

- UK Nationwide House Prices Worse

- See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Development Securities net asset value falls 0.9 percent

- BG, Ophir say latest Tanzania well better than expected

- Meggitt says Q1 revenues ‘grew modestly’

- Henderson – First quarter net outflows 1.3 bln stg

- Weir– trading resilient, in line with expectations

- UK’s Home Retail year profit falls again

- Balfour Beatty makes PFI asset sales

- Antofagasta Q1 copper output up, on track to hit 2013 target

- Bunzl buys Australian safety equipment businesses

- Sportech says customs seeks appeal on VAT ruling

- Kentz wins Colombian refinery contract

- Stanley Gibbons Q1 trading in line

- Genel signs rig contract for African drill

- Melrose sells Truth Hardware to Tyman for $200 mln