Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

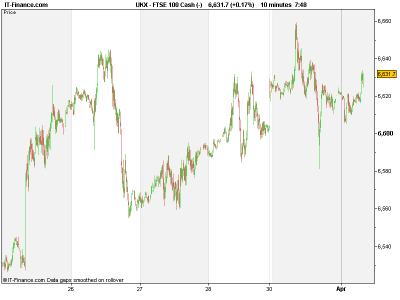

UK 100 called to open +25pts at 6630, a similar level to yesterday, recovering from a bout of near-the–close weakness generated by a US data miss by the Chicago Fed (notably the employment component) thanks to an apparent thinning out of Russian troops on the Ukrainian border and some official Chinese Manufacturing data offering hope of resilience amid weakening trends which could help natural resources names again.

US markets closed with decent gains (the S&P’s 5th consecutive quarterly gain) thanks to dovish comments by the Fed’s Yellen (US economy still needs help) and some potential geopolitical progress on this side of the pond thanks to ongoing resolution talks and confirmation from Russian President Putin to German Chancellor Merkel that he had ordered a partial withdrawal of troops from Eastern Ukraine.

Note after the Eurozone reported more disinflationary data yesterday in the form of CPI at four-year lows which may spur the ECB to act with stimulus, the IMF did comment that the central bank has room for both conventional and unconventional easing measures ahead of Thursday’s much awaited policy decision.

Asian markets a little more mixed overnight, swinging between gains and losses, with Japan in the red after a disappointing batch of manufacturing macro data and today marking the day that the country’s consumption tax increases, amid PM Abe’s attempt to end deflation. Many believe the country can withstand the increase thanks to the economic stimulus measure and wage rises.

Australia just in the red as the AUD strengthened thanks to no change in monetary policy and despite major trading partner China posted another PMI Manufacturing reading in growth territory, even if slowing and HSBC’s version remained in contraction. Hong Kong equities positive as a result, helped also by China’s PBOC intervention to drain liquidity and shift towards a tighter stance.

In focus today we have Eurozone PMI Manufacturing data, which after the weak inflation yesterday and recent PMIs suggesting recovery, will be keenly watched for. All seen in growth >50. German and Eurozone Unemployment seen stable. UK PMI Manufacturing seen holding up nicely well above 55. The latest BoE Minutes will be of interest for GBP.

In the afternoon, US PMI Manufacturing seen improving along with ISM Manufacturing. A big day for Manufacturing.

In Commodities: Gold fell to $1,278.20 oz, the lowest since Feb 11, near a 7-week low, as investors weighed the outlook for the Fed’s monetary policy. Copper advances to $6,670.25/tn, a three-week high after the official Chinese PMI Manufacturing beat estimates, increased the prospects for demand from the world’s biggest consumer. WTI crude at $101.28 and Brent crude at $107.70 a barrel on speculation US crude supplies expanded for the 11th week.

In FX: The Dollar reached $1.3776 against the Euro and was little changed at 103.26 against the Yen as investors weigh whether US economic data this week will be strong enough to assuage central bank concerns the economy still needs stimulus, notably after Yellen’s comments. The Euro reached 142.24 against the Yen. Australia’s dollar reached 93.04 against the US Dollar after the RBA left rates unchanged.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- CN Official Manufacturing PMI Beat, Improved

- CN HSBC Manufacturing PMI Miss, Deteriorated

- AU Interest rate In-line, Unchanged

- JP Manufacturing Surveys Mixed, Disappointing

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Jupiter Fund Management sells private client ops to Rathbone Brothers

- Londonmetric agrees 1 mln sq ft pre-let for distribution centre

- Jupiter sells private client, charity ops to Rathbones

- Icap says global broking revenue curbed by slower market activity

- Babcock secures 21-year contract for London Fire Brigade

- Rathbones boosts assets with two wealth manager acquisitions